The art market tends to be seen as a luxury market. But this article is going to show you that it’s a far more affordable market than you’d think, especially in the last few years. For a long time art was just for the wealthy classes but those days are long gone. Everyone has always believed that the art market was out of their reach because artworks can be eye-wateringly expensive. But actually it’s only the most expensive pieces that get the most media coverage and the market is expanding to reach a wider audience. It’s far more mainstream and affordable since art has become more approachable in the post-pandemic market.

So why invest in art?

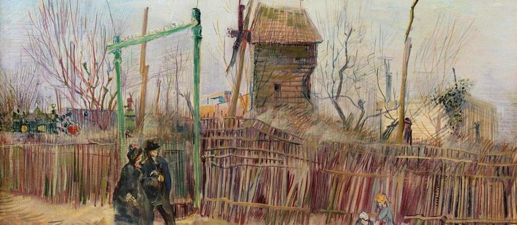

You may know that art can increase in value, sometimes even soar in value. Just take the “unknown” painting by Van Gogh (Scène de rue à Montmartre – 1887) which sold for 13.1 million Euros in March 2021 in Paris, despite being bought for far less in the 1920s. Patience is a virtue. Why did it sell for so much? Because it was one of the artist’s last pieces in private ownership and it had never been on public display.

Not everyone is lucky enough to stumble upon such a valuable piece in their parents’ or grandparents’ attic but a little-known artist today could become a big hit in the next few years or decades.

Imagine owning a piece like that. Art has much to offer if you want to invest. Its value is two-fold: financial and sentimental. People tend to buy art because they like it. If you want to focus on its financial aspect, you have to look into its potential to increase in value. But remember that nothing is set in stone: Art isn’t like other financial assets and buying/selling art involves significant transaction costs albeit less sensitive to fluctuations in the economy than many other assets…

There are three types of art buyer: collectors, investors and flippers. We’re going to focus on investors because the market’s digitalisation has made it easier than ever to buy art even at low prices. Artprice, the world leader of art market information, found that buying and reselling artwork can give you an annual return of over 10% on paintings, sculptures and photographs worth in excess of 100,000 €. Once you’ve found/saved 100,000 €, how do you invest and what are the criteria?

First, you need to review the market’s trends. Find out how much artworks/artists/movements are increasing in value and get to grips with the current market. Let’s take China for example, a country that has recently become a world leader in the art market. It has grown quickly in the art sector and most people see it as an investment.

Next, take a gamble and bet on what’s current. Let’s take street art, a movement that everyone knows about to some extent and has been made famous by Banksy. It’s a movement that captures a stance and mind-set in several areas: politics, society, economy and even religion. Street art is all the rage so it has different prospects for the future. If you’re no expert then it’s best to go with a sure bet. Contemporary art may be worthwhile. You can unearth up-and-comers who are making a splash at fairs, galleries or among collectors and who could prove to be a very lucrative investment.

Would you like to invest? Don’t forget to consider art-related services such as shipping. Now the art market is becoming more affordable and within everyone’s reach, you need to research the services that go with it so you don’t get any nasty surprises and end up paying more for shipping than the piece itself!

Now all you need to do is get a quote on our website to get an idea of how much your latest purchase will cost to ship.